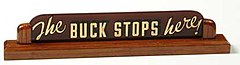

The expression itself is thought to originate from poker, whereby a marker or counter indicates whose turn it is to deal. A player could pass the "buck" into the next player and thus buck his responsibilities.

In international relations the phrase has come to mean the tendency of nation-states to refuse to confront an escalating issue in the hope that another nation will step up to the mark. Perhaps a more fitting representation of playing hot potato with multi-national responsibilirt would be the phrase "The Euro Stops Here". But then, where does the Euro actually stop?

In international relations the phrase has come to mean the tendency of nation-states to refuse to confront an escalating issue in the hope that another nation will step up to the mark. Perhaps a more fitting representation of playing hot potato with multi-national responsibilirt would be the phrase "The Euro Stops Here". But then, where does the Euro actually stop?

I don't just mean in terms of the currency itself. The very problem with the single currency was that it was created without any sense of centralised control. Instead a sort of Ashram-style communcal ownership of the currency was forged. But as the edifice began to crumble, all of a sudden shared responsibilities were denied and finger pointing, points-scoring and accusatory proclamations shattered the previously optimistic murmured assent of the great single currency project.

It is of course summer recess in Brussels. That means the big boys in the EU are essentially on their holibobs, leaving nobody to call their shots for a couple of weeks and essentially passing the onus onto the European Central Bank to calm the waters before everyone can return to the drawing board and bang their heads together once again.

It is of course summer recess in Brussels. That means the big boys in the EU are essentially on their holibobs, leaving nobody to call their shots for a couple of weeks and essentially passing the onus onto the European Central Bank to calm the waters before everyone can return to the drawing board and bang their heads together once again.Rather unhelpfully, the ECB President Mario Draghi has been left the usual script.

Phrases like "The single currency is not reversible" and "The ECB will do whatever it takes to save the Euro" are being jettisoned out at the world's media, who, of course, have heard it all before.

Then there was even the line “In the coming weeks we will design the appropriate modalities for such policy measures,” alongside the usual affirmation that eurozone countries "must use the time constructively to move towards closer integration in the eurozone".

The ECB's bond-buying programme had managed to actually bring down the costs of government borrowing in the Eurozone via the trade between banks and government institutions on the secondary market. However this was shut down in January and anyway, actual costs of government borrowing are largely determined at auctions in the primary market where bonds are sold directly to banks (bonds are essentially I.O.U.s which certain crafty financiers agree to "buy" ata rate of interest which they believe will land them a sizeable profit. Of course, the less desirable the I.O.U. the higher the rate of interest demanded by the potential purchaser). It is here that the ECB would need to bring down the costs in much the same way as the Bank of England has done in the UK, effectively spending 20% of UK national income on government debt.

The ECB's bond-buying programme had managed to actually bring down the costs of government borrowing in the Eurozone via the trade between banks and government institutions on the secondary market. However this was shut down in January and anyway, actual costs of government borrowing are largely determined at auctions in the primary market where bonds are sold directly to banks (bonds are essentially I.O.U.s which certain crafty financiers agree to "buy" ata rate of interest which they believe will land them a sizeable profit. Of course, the less desirable the I.O.U. the higher the rate of interest demanded by the potential purchaser). It is here that the ECB would need to bring down the costs in much the same way as the Bank of England has done in the UK, effectively spending 20% of UK national income on government debt.The same sort of intervention by the ECB would be a bond purchase of around €1.6 trillion.

But the ECB's constitution prevents it from lending money to

European governments, precluding it from buying bonds at government debt

auctions in the primary market.

But the ECB's constitution prevents it from lending money to

European governments, precluding it from buying bonds at government debt

auctions in the primary market.Instead, under the Eurogroup plan, the EFSF (European Financial Stability Facility, or to you and I, the bail-out fund) would do the buying...through the ECB.

The problem is however that the bail out fund which at one point had €440billion has already thrown €200billion at Greece, Ireland and Portugal and has recently committed another €100billion to Spanish banks.

Yet the ECB has also stated that "first of all governments need to go to the EFSF; the ECB cannot replace governments". But there's nothing really lefy in the EFSF, and what's more the statement made by the ECB was not really backed up by one vital player: Jens Weidmann, head of Germany's influential Bundesbank, the ECB's biggest shareholder. The very fact that Draghi named the dissenter was clear intent that rather than buttering up Germany as potential paymaster, the institutions are tempted to round upon the economic powerhouse by portraying Germany as some kind of Judas.

Yet the ECB has also stated that "first of all governments need to go to the EFSF; the ECB cannot replace governments". But there's nothing really lefy in the EFSF, and what's more the statement made by the ECB was not really backed up by one vital player: Jens Weidmann, head of Germany's influential Bundesbank, the ECB's biggest shareholder. The very fact that Draghi named the dissenter was clear intent that rather than buttering up Germany as potential paymaster, the institutions are tempted to round upon the economic powerhouse by portraying Germany as some kind of Judas.He is without doubt fully aware that all this chit chat must get through Germany's Constitutional Courts in September.

Draghi has also reaffirmed that national governmens had to do their bit and stick to, if not enhance, already devastating austerity measures and use their bail out funds before turning cap in hand to the Central Bank.

Essentially all we have heard from Draghi is the usual rhetoric designed to temporarily calm the storm while everyone enjoys their vacation. However, perhaps significantly, the German Government has backed the ECB's statement despite officials at the German central bank being openly critical of using

ECB resources to buy the bonds of struggling countries such as Greece or

Spain as against the spirit of the

ECB’s statutes, which forbid it to finance states. The bank simply reiterated that “There haven’t been

any changes” on this position.

Essentially all we have heard from Draghi is the usual rhetoric designed to temporarily calm the storm while everyone enjoys their vacation. However, perhaps significantly, the German Government has backed the ECB's statement despite officials at the German central bank being openly critical of using

ECB resources to buy the bonds of struggling countries such as Greece or

Spain as against the spirit of the

ECB’s statutes, which forbid it to finance states. The bank simply reiterated that “There haven’t been

any changes” on this position.The question over whether the ECB could grant the proposed €500billion rescue fund a banking license in order for it to borrow from the ECB has been shot down by Germany. Yet while the Bundesbank cannot veto ECB policy decisions, the very fact that Germany is the biggest shareholder in the ECB due to the size of her economy means it is vital that they are on board.

And so we have in practice what the EU was designed to prevent.

And so we have in practice what the EU was designed to prevent.The question of on who's desk the sign "The Euro Stops Here" should sit is increasingly obvious to us all. Once again the future of Europe will likely be determined in the Bundestag unless all the other European states can combine forces to overcome her might.

The EFS is barely capitalized at 500 billion Euros, and its' nowhere close enough to bail out Spain, much less Italy. Given Germany's utter determination to avoid any kind of joint-liability, it is inevitable that this is going to end badly - very badly.

ReplyDelete